Your Moving boxes cost reimbursement taxable images are ready. Moving boxes cost reimbursement taxable are a topic that is being searched for and liked by netizens now. You can Find and Download the Moving boxes cost reimbursement taxable files here. Download all free photos and vectors.

If you’re looking for moving boxes cost reimbursement taxable images information related to the moving boxes cost reimbursement taxable topic, you have pay a visit to the right blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

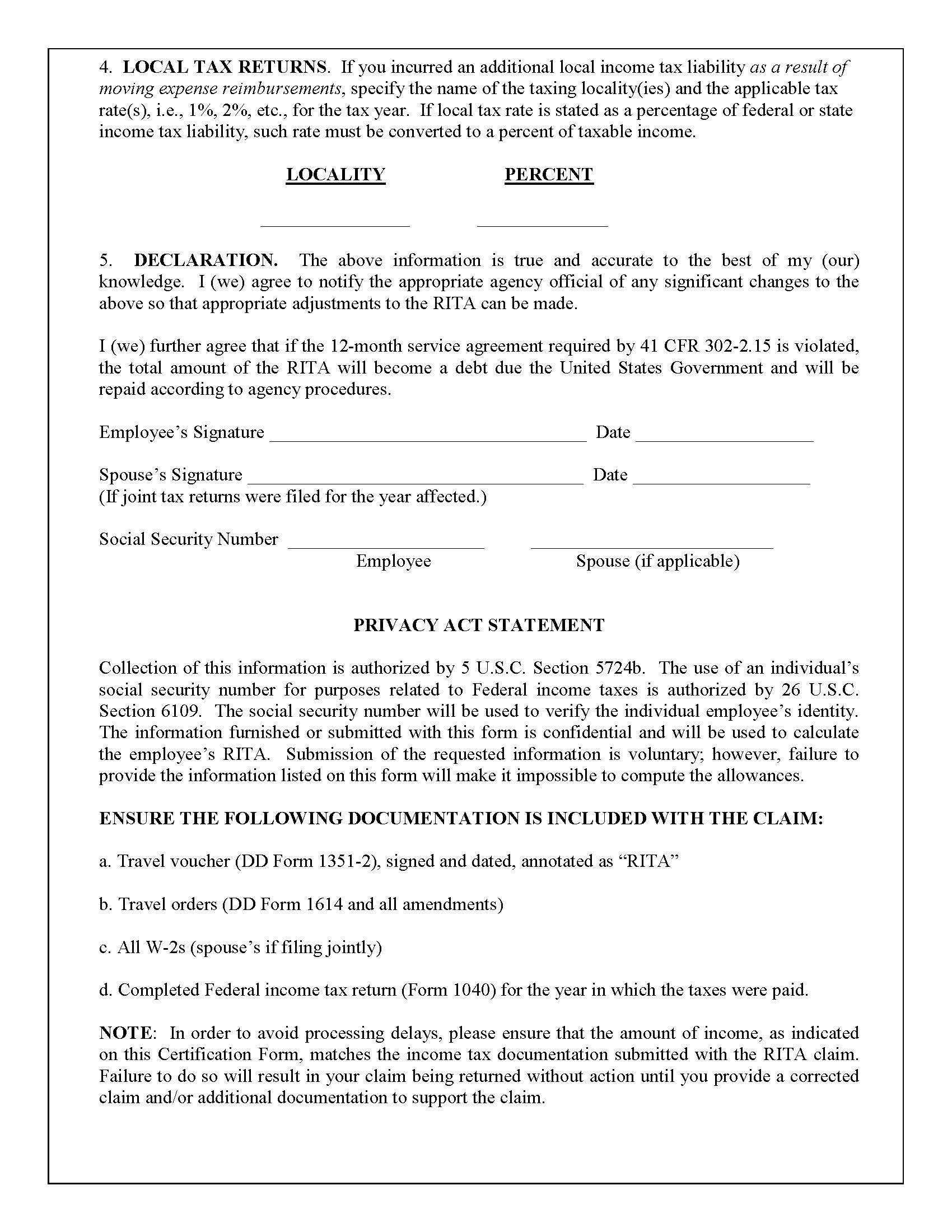

Moving Boxes Cost Reimbursement Taxable. If box 14 represents tax-free moving assistance that is still a number you need to know because you can still deduct moving expenses that were more than the tax-free assistance. Taxes will be automatically deducted from the payment and reported on the employees current year W-2. Box 14 is not taxable and is only for information purposes. Unfortunately for taxpayers moving expenses are no longer tax-deductible when moving for work.

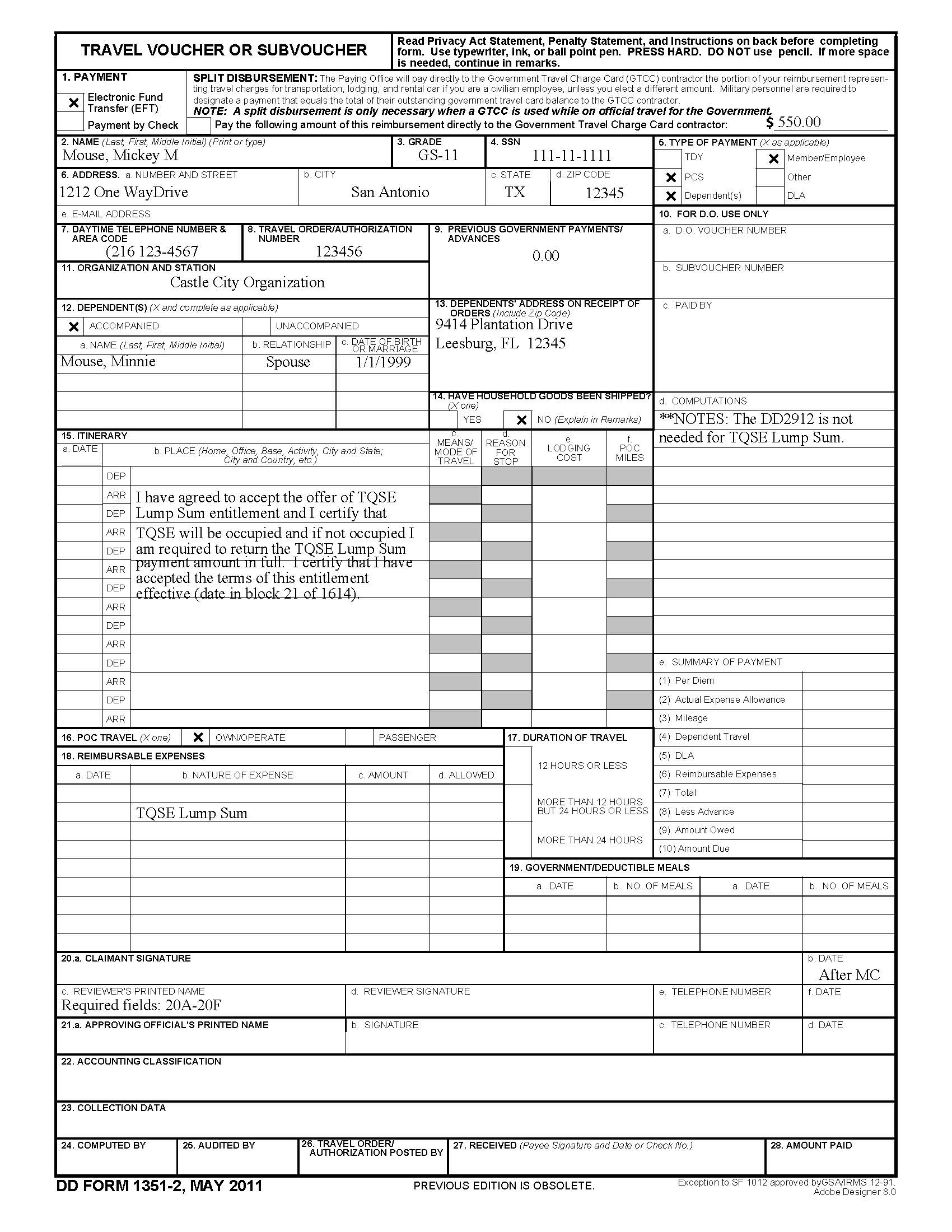

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Temporary Quarters Subsistence Expenses From dfas.mil

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Temporary Quarters Subsistence Expenses From dfas.mil

Actual costs incurred for truck rental excluding insurance boxes packing materials and gasoline for rental truck supported by original receipts. Moving expenses incurred during that time period will not be a deductible expense except for certain members of the Armed Forces and. That makes the amounts taxable for everyone except active-duty service members whose relocations are connected to military-ordered permanent changes of station. Costs such as meals and lodging in. Relocation costs can include. When you transfer an employee from one of your places of business to another the amount you pay or reimburse the employee for certain moving expenses is usually not a taxable benefit.

These changes are effective for taxable years beginning after December 31 2017 and.

If box 14 represents tax-free moving assistance that is still a number you need to know because you can still deduct moving expenses that were more than the tax-free assistance. The Act repealed the federal deduction for moving expenses and the exclusion for qualified moving expense reimbursements paid by an employer with an exception for members of the armed forces on active duty. But due to IRS regulations and tax law expenses are considered taxable. O Reimbursement to new employees who elect to move themselves may not exceed the costs that would have been incurred had a commercial firm been used. Under the TCJA reimbursements for moving expenses made to employees or paid directly to third parties on and after January 1 2018 and through December 31 2025 are included in wages subject to federal income tax FIT federal income tax withholding FITW Social SecurityMedicare FICA and federal unemployment insurance FUTA. Other relocation expenses these are counted as non-qualifying costs and.

Source: dfas.mil

Source: dfas.mil

This includes any amounts you incurred to move the employee the employees family and their household effects. As a result your company will have more flexibility to define reimbursable expenses and could relax or even eliminate its substantiation requirements. Also the amount is excludable from wages and compensation. This includes any amounts you incurred to move the employee the employees family and their household effects. Application of Withholding Tax.

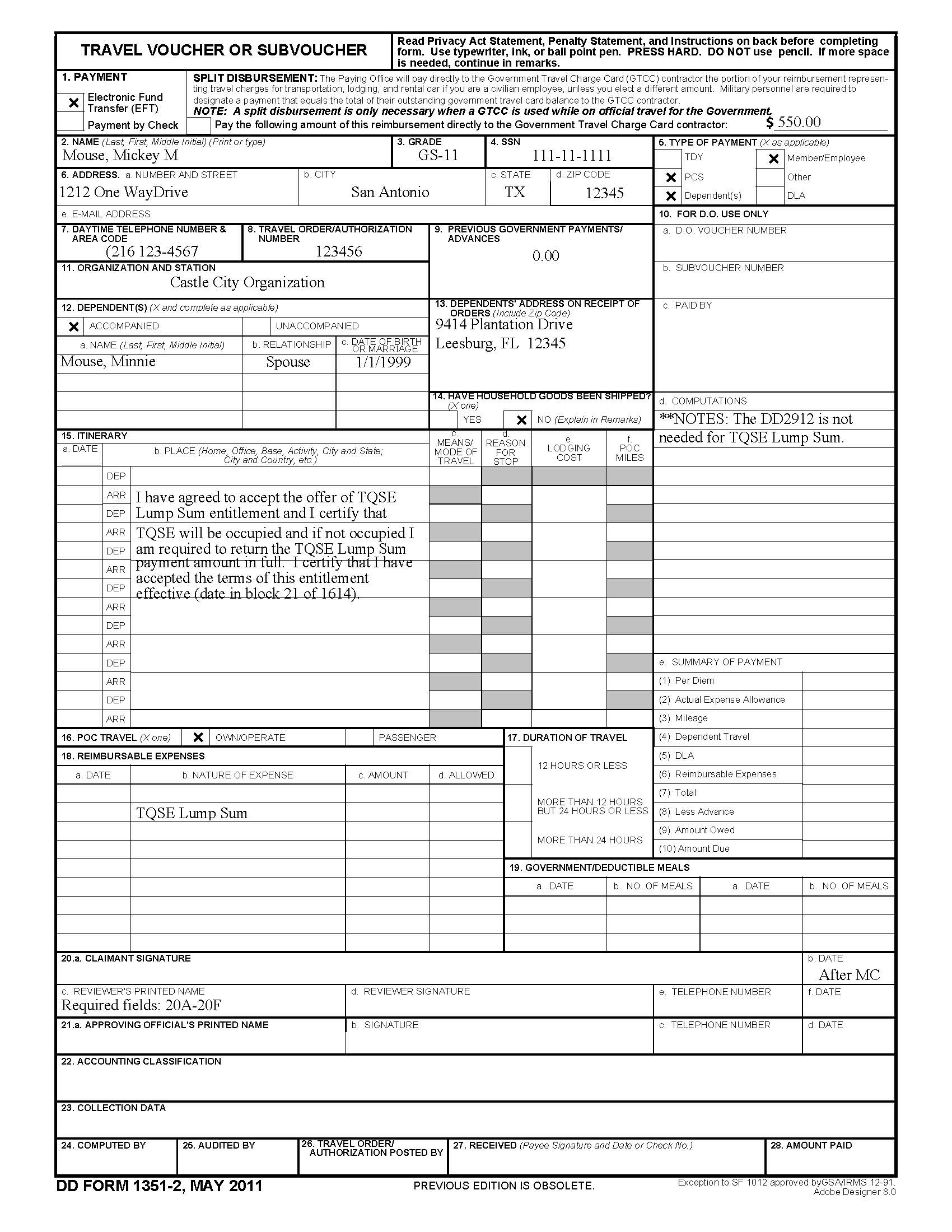

Source: lifeinduesseldorf.com

Source: lifeinduesseldorf.com

Costs such as meals and lodging in. Under IRC217 only the costs of moving personal belongings and traveling to the new location are deductible. The deduction will be reduced by the tax free reimbursement. As part of her package her employer gave her a 10000 relocation signing bonus and also paid a moving company 22000 directly. When you transfer an employee from one of your places of business to another the amount you pay or reimburse the employee for certain moving expenses is usually not a taxable benefit.

Source: link.springer.com

Source: link.springer.com

If your company decides to continue helping new employees pay for their moving expenses its total cost could rise due to the FICA tax but reimbursements will not be limited by the Code 217 deduction. Ive looked all over the internet and cant find an answer. The Tax Cuts and Jobs Act TCJA suspended the income exclusion for moving expenses reimbursed or paid by an employer for most employees starting in 2018. Buying or selling a home. Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the employer after December 31 2017 is excludable from income as a qualified moving expense reimbursement.

Source: dfas.mil

Source: dfas.mil

If so can you give me some documented support for that. As part of her package her employer gave her a 10000 relocation signing bonus and also paid a moving company 22000 directly. Therefore effective Jan. The moving expense reimbursement for tax year 2018 is showing up in box 1 and box 14 of my employees W-2. The rules for moving expenses are found in IRS Publication 521This is an excerpt from an explanation in IRS Tax Topic 455.

Source: yumpu.com

Source: yumpu.com

This also applies when the employee accepts employment at a different. Amounts will be treated as taxable whether they are reimbursed to an employee or paid directly to a vendor. Salary increases are usually easier to understand as taxable income but employees may find it more difficult to accept an additional tax burden resulting from a moving. Also the amount is excludable from wages and compensation. Other relocation expenses these are counted as non-qualifying costs and.

Source: dfas.mil

Source: dfas.mil

An exception to this. Bonuses as incentives or payments to defray increased cost of living must not be confused with employer paid moving expenses. If so can you give me some documented support for that. Are moving expenses taxable. The Tax Cuts and Jobs Act TCJA suspended the income exclusion for moving expenses reimbursed or paid by an employer for most employees starting in 2018.

Source: approve.com

Source: approve.com

Travelling costs including a reasonable amount spent for. Under the TCJA reimbursements for moving expenses made to employees or paid directly to third parties on and after January 1 2018 and through December 31 2025 are included in wages subject to federal income tax FIT federal income tax withholding FITW Social SecurityMedicare FICA and federal unemployment insurance FUTA. Ive looked all over the internet and cant find an answer. Costs such as meals and lodging in. According to the IRS the moving expense deduction has been suspended thanks to the new Tax Cuts and Jobs Act.

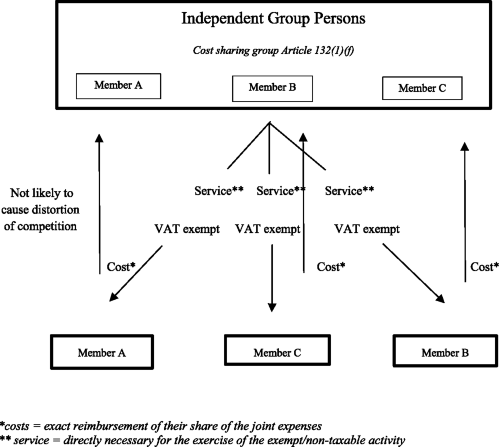

Source: sampleforms.com

Source: sampleforms.com

Are moving expenses taxable. The Act repealed the federal deduction for moving expenses and the exclusion for qualified moving expense reimbursements paid by an employer with an exception for members of the armed forces on active duty. Travelling costs including a reasonable amount spent for. You can deduct your moving expenses if you meet all three of the following requirements. The moving expense reimbursement for tax year 2018 is showing up in box 1 and box 14 of my employees W-2.

Source: pinterest.com

Source: pinterest.com

Not all employees are eligible to be reimbursed for expenses listed here. Buying certain things for a new home. O Reimbursement to new employees who elect to move themselves may not exceed the costs that would have been incurred had a commercial firm been used. The moving expense reimbursement for tax year 2018 is showing up in box 1 and box 14 of my employees W-2. The Tax Cuts and Jobs Act TCJA suspended the income exclusion for moving expenses reimbursed or paid by an employer for most employees starting in 2018.

Source: dfas.mil

Source: dfas.mil

Moving expenses paid by employer that are not a taxable benefit. Are reimbursed moving expenses taxable in 2019. Taxes will be automatically deducted from the payment and reported on the employees current year W-2. 1 2018 all moving expense reimbursements are taxable to the employee. On the other hand Withholding Tax-related.

Source: yumpu.com

Source: yumpu.com

According to the IRS the moving expense deduction has been suspended thanks to the new Tax Cuts and Jobs Act. An exception to this. The moving expense reimbursement for tax year 2018 is showing up in box 1 and box 14 of my employees W-2. Application of Withholding Tax. You need to know whether the moving support was included as part of your box 1 taxable wages or not.

Source: yumpu.com

Source: yumpu.com

You need to know whether the moving support was included as part of your box 1 taxable wages or not. This includes any amounts you incurred to move the employee the employees family and their household effects. Expenses for an employee move relocation may be eligible for payment or reimbursement by UCSD. The taxable portion of the moving expenses is the only deductible portion. Ive looked all over the internet and cant find an answer.

Source: crowe.com

Source: crowe.com

Bonuses as incentives or payments to defray increased cost of living must not be confused with employer paid moving expenses. Under the TCJA reimbursements for moving expenses made to employees or paid directly to third parties on and after January 1 2018 and through December 31 2025 are included in wages subject to federal income tax FIT federal income tax withholding FITW Social SecurityMedicare FICA and federal unemployment insurance FUTA. Yes moving expenses are counted as taxable income whether its a relocation bonus moving allowance or moving expenses paid directly by the company. Refer to Reimbursable MoveRelocation Expenses for Staff to learn about allowable expenses. What are fringe benefits and are they taxable.

Source: investopedia.com

Source: investopedia.com

Application of Withholding Tax. On the other hand Withholding Tax-related. These changes are effective for taxable years beginning after December 31 2017 and. Under IRC132g an employee may exclude the amount paid or reimbursed by the employer that would be deductible under IRC217. When you transfer an employee from one of your places of business to another the amount you pay or reimburse the employee for certain moving expenses is usually not a taxable benefit.

Source: dfas.mil

Source: dfas.mil

Expenses for an employee move relocation may be eligible for payment or reimbursement by UCSD. The cost of house hunting trips to the new location including child care and pet care expenses while the employee is away. The employee will be taxed for these additional amounts as if they were wages or income. IRS moving deductions are no longer allowed under the new tax law. Also the amount is excludable from wages and compensation.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title moving boxes cost reimbursement taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.